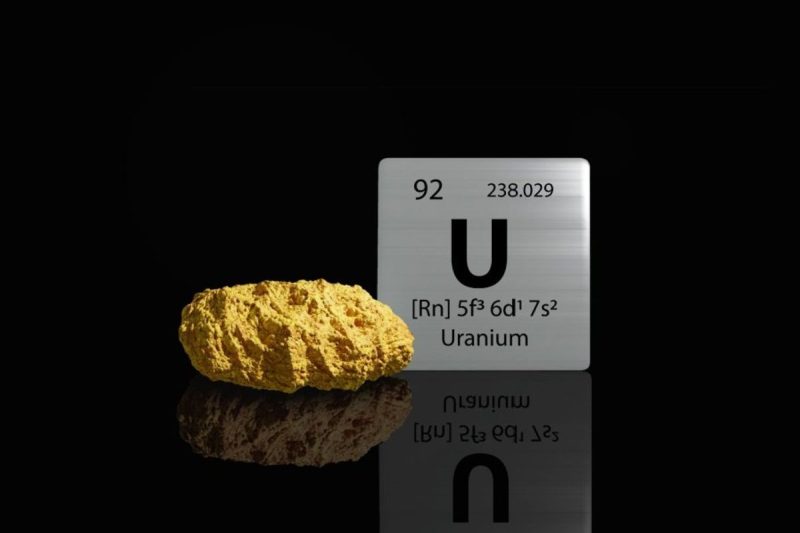

The uranium spot price displayed volatility in Q1, rising to a high unseen since 2007 before ending the quarter below US$90 per pound. U3O8 values shed 3.96 percent over the three month period, but experts believe fundamentals remain strong and expect the sector to benefit from various tailwinds in the months ahead.

Supply remains a key factor in the uranium landscape, with a deficit projected to grow amid production challenges. With annual output well below the current demand levels, the supply crunch is expected to be a long-term price driver.

These favorable fundamentals are expected to support uranium prices for the remainder of the year.

Finegold also noted that spot market activity highlights how sensitive the sector is to supply challenges.

“Spot market prices have also been a key talking point as volatility in pricing has increased dramatically in Q1 to both the upside and downside,” he explained. “It has brought to light just how thinly traded the spot market is, but interestingly term prices have only continued to rise, which is indicative that the long-term fundamentals remain intact.”

Sulfuric acid shortage impeding supply growth

The U3O8 spot price opened the year at US$91.71 and edged higher through January 22, when values hit a 17 year high of US$106.87. However, the near two decade record was short lived, and by month’s end uranium was around US$100.

Uranium price, Q1 2024.

Chart via Cameco.

Some of the price positivity early in the quarter came as Kazatomprom (LSE:KAP,OTC Pink:NATKY) warned that it was expecting to adjust its 2024 production guidance due to “challenges related to the availability of sulfuric acid.”

The state producer and major uranium player confirmed the reduction on February 1, underscoring the importance of sulfuric acid in its in-situ recovery method and describing its efforts to secure supply.

“Presently, the company is actively pursuing alternative sources for sulfuric acid procurement,” a press release states.

“Looking ahead in the medium term, the deficit is expected to alleviate as a result of the potential increase in sulphuric acid supply from local non-ferrous metals mining and smelting operations. The company also intends to enhance its in-house sulfuric acid production capacity by constructing a new plant.”

In 2023, Kazatomprom initiated the establishment of Taiqonyr Qyshqyl Zauyty to oversee the construction of a new sulfuric acid plant capable of producing 800,000 metric tons annually.

In the years ahead, the company is aiming to bolster its sulfuric acid production capacities through existing partnerships to achieve a consolidated production volume of approximately 1.5 million metric tons.

In the meantime, disruptions to Kazakh output will only grow the market deficit.

According to the World Nuclear Association, total global uranium production in 2022 only satiated 74 percent of global demand, a number that is likely to shrink as nuclear reactors in Asian countries begin coming online.

“Kazakhstan is the largest producer of uranium in the world — 44 percent. We like to think of Kazakhstan as the OPEC of uranium,” John Ciampaglia, CEO of Sprott Asset Management, said during a recent webinar.

Kazatomprom forecasts its adjusted uranium production for 2024 will range between 21,000 and 22,500 metric tons on a 100 percent basis, and 10,900 to 11,900 metric tons on an attributable basis. While in line with the company’s 2023 output, the major had to forgo a production ramp up due to the sulfuric acid shortage and development issues.

Analysts and market watchers foresee the sulfuric acid shortage being a long-term price driver.

“The sulfuric acid issue in Kazakhstan is a systemic problem that we do not believe will go away any time soon,” said Finegold. “While the company is doing what they can to alleviate pressures on sulfuric acid supplies, we believe their ability to ramp up production will be hindered for several years before their third domestic plant comes online. As such, we do not see Kazakh uranium production increasing significantly over the next three to four years.”

COP28 nuclear commitment supporting demand

The U3O8 spot price spiked again in early February, reaching US$105 before another correction set in.

As Finegold explained, some of the retraction was the result of profit taking from short-term holders.

“Financial speculators looking to lock in profits towards March year ends played a role, but as we know these moves are achieved on very little volume, so the point remains that the long-term thesis remains unchanged,” he said.

Finegold went on to highlight the different investment perspectives within the market.

“Spot market participants trade on very different parameters and time horizons to one another,” he said. “A trader and a hedge fund, for example, act in a totally different manner to a utility who are long-term thinkers.”

Despite February’s slight contraction, uranium prices have remained elevated above US$80.

Some of this long-term support is the result of a COP28 nuclear capacity declaration. At the organization’s December meeting in Dubai, more than 20 countries signed a proclamation to triple nuclear capacity by 2050.

There are currently 440 operational nuclear reactors with an additional 13 slated to come online this year and another 47 expected to start electricity generation by 2030. For Finegold, this commitment to building and fortifying nuclear capacity has been uranium’s most prevalent demand trend. “The demand side of the equation remains robust and growing at a time when the supply side has never been more fragile,” he commented.

Others also believe the COP28 commitment was a tipping point for the uranium market that spawned several announcements about mine restarts and project extensions.

“Governments around the world have acknowledged that they need to be more supportive, not just financially, but in terms of expediting new projects, expediting the environmental permitting processes for new uranium mines,” said Sprott’s Ciampaglia during the webinar. “And it’s not just happening in one country — with the exception of one or two outliers in Europe, this is happening around the globe.”

Geopolitical risk and resource nationalism are price catalysts

Uranium prices continued to consolidate from mid-February through mid-March, but remained above US$84.

This positivity saw several uranium companies in the US, Canada and Australia announce plans to bring existing mines out of care and maintenance. In late November, uranium major Cameco (TSX:CCO,NYSE:CCJ) announced it was restarting operations at its McArthur River/Key Lake project in Saskatchewan after four years.

In January, the McClean Lake joint venture which is co-owned by Denison Mines (TSX:DML,NYSEAMERICAN:DNN) and Orano Canada, reported plans to restart its McClean Lake project, also located in the Athabasca Basin of Saskatchewan.

South of the border, exploration company IsoEnergy (TSXV:ISO,OTCQX:ISENF) is gearing up to restart mining at its Tony M underground mine in Utah. “With the uranium spot price now trading around US$100 per pound, we are in the very fortunate position of owning multiple, past-producing, fully permitted uranium mines in the U.S. that we believe can be restarted quickly with relatively low capital costs,’ IsoEnergy CEO and Director Phil Williams said in a February release.

Building North American capacity is especially important ahead of the global nuclear energy ramp up and the ongoing geopolitical tensions between Russia and the west. While nuclear power is used to provide nearly 20 percent of America’s electricity, the nation produces a very small amount of the uranium it needs.

Instead, the country imports as much as 40.5 million pounds annually.

According to the US Energy Information Administration, 27 percent of imports come from ally nation Canada, while 25 percent of imports come from Kazakhstan and 11 percent originate in Uzbekistan — both considered allies of Russia.

Commenting on that topic, Finegold noted, “The ongoing talk around US sanctions remains the most significant geopolitical catalyst for the sector.’ He added, ‘While we do not believe sanctions could be enforced immediately, it will send a signal to the market that Russia will no longer be involved in the largest uranium market in the world and would inevitably have an impact on fuel cycle component prices.”

If sanctions do limit imports from Russian allies, Finegold expects these countries to form stronger ties to China.

“Outside of this, the relationship between Kazakhstan and China remains one to watch as the Chinese continue their nuclear rollout strategy and look to procure millions of Kazakh-produced pounds,” he added.

Uranium price outlook remains positive

After hitting a Q1 low of US$84.84 on March 18, uranium began to move positively, ending the three month session in the US$88 range. Commitments to nuclear capacity, the energy transition and stifled supply will continue to be the most prevalent market drivers heading into the second quarter and the rest of the year.

“We believe uranium prices will significantly outrun the recent US$107 highs from February in 2024, driven by a fundamental supply/demand imbalance,” said Finegold. “Producers will continue to cover production shortfalls, while utilities struggle to replenish inventory shortages.”

The Ocean Wall associate went on to note, “The inherent appetite of traders and financial speculators will continue to drive prices higher. These demand drivers are converging at a time when supply has never looked more fragile.”

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.