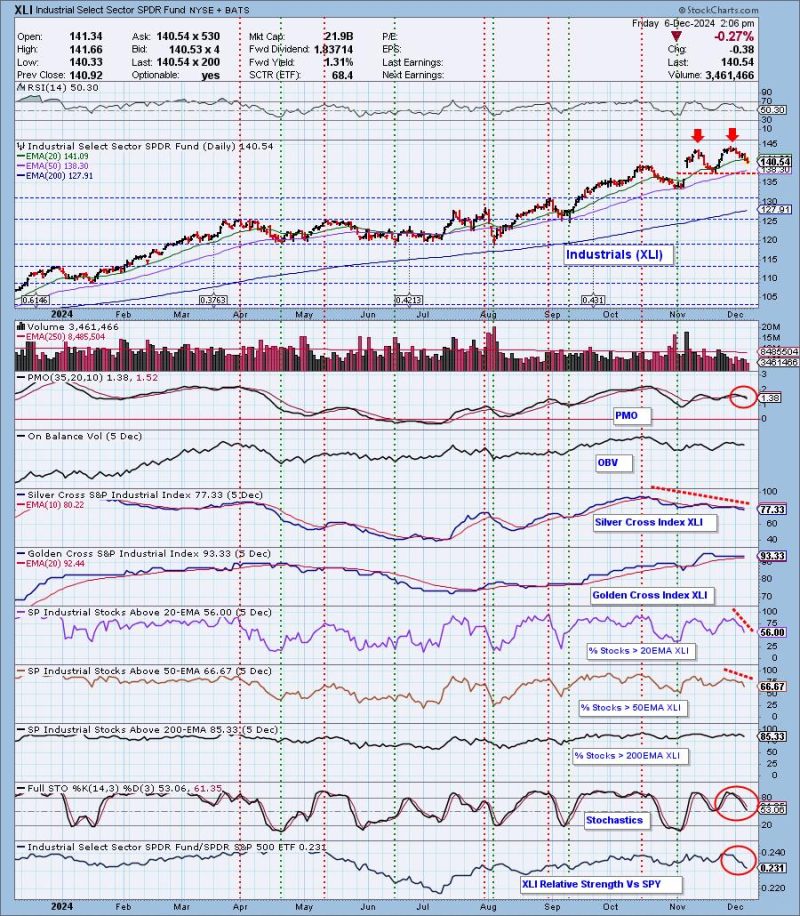

Industrials (XLI) benefited greatly from the “Trump Trade”, but fell back to digest the gap up rally. It rallied again, but failed after overcoming overhead resistance at the prior November top. Now it is pulling back once again, which that has formed a bearish double top formation. The bearish double top’s minimum downside target would bring price down to the next level of support around 132.00.

To add insult to injury, on Thursday, XLI saw a Price Momentum Oscillator (PMO) Crossover SELL Signal. Participation has been sinking since the last top and, while percentages of stocks above key moving averages are above our bullish 50% threshold, the sector is clearly breaking down while the SPY makes new all-time highs.

A further issue is the negative divergence on the Silver Cross Index. It is also below its signal line, so the IT Bias is BEARISH. Relative strength is being sucked out of the sector right now.

Conclusion: Industrials (XLI) may have benefited from the election, but the shine has worn off the trade. More stocks are losing support at key moving averages and the IT Bias is BEARISH. This is a sector we likely want to avoid given the downside target of the double top formation is around 132.00.

Introducing the New Scan Alert System!

Delivered to your email box at the end of the market day. You’ll get the results of our proprietary scans that Erin uses to pick her “Diamonds in the Rough” for the DecisionPoint Diamonds Report. Get all of the results and see which ones you like best! Only $29/month! Or, use our free trial to try it out for two weeks using coupon code: DPTRIAL2. Click HERE to subscribe NOW!

Learn more about DecisionPoint.com:

Watch the latest episode of the DecisionPointTrading Room on DP’s YouTube channel here!

Try us out for two weeks with a trial subscription!

Use coupon code: DPTRIAL2 Subscribe HERE!

Technical Analysis is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This blog is for educational purposes only and should not be construed as financial advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

DecisionPoint is not a registered investment advisor. Investment and trading decisions are solely your responsibility. DecisionPoint newsletters, blogs or website materials should NOT be interpreted as a recommendation or solicitation to buy or sell any security or to take any specific action.

Helpful DecisionPoint Links:

Price Momentum Oscillator (PMO)